House prices

10 November 2022

The publication of the Local Housing Price Statistics for the 2nd quarter of 2022 (Q2 2022) allows us to trace – over more than four years – the evolution of housing prices in Portugal.

This article presents, for each geographical area, a table with the evolution of prices between Q1 2018 and Q1 2020, and a second table with the values registered between Q2 2020 and Q2 2022.

Important note: between the end of the 2nd quarter (to which the most recent data shown here relates) and today, the European Central Bank raised key interest rates three times. Meaning: the maximum amount that many families can spend on a house today, is lower than the amount that these same families could have paid in January of this year.

But I will return, in more detail, to this issue and its presumed consequences at the end of the article.

MUNICIPALITIES IN THE

LISBON METROPOLITAN AREA

By Carlos Caetano.

Q1 2018 – Q1 2020

Source: Statistics Portugal.

Q2 2020 – Q2 2022

Source: Statistics Portugal.

Tables 1.1 and 1.2 [values in red represent price drops compared to the previous quarter, and the ones in bold register peaks in that municipality during the period in question] show that the value of housing in the Lisbon Metropolitan Area (LMA) has risen consistently. To the point of verifying that in 17 of the 18 municipalities in the LMA, historical peaks were registered in the 2nd quarter of 2022 (the exception was Alcochete, where the median value remained exactly the same).

But do you know what gives consistency to this trend? The fact that in the previous quarter, all the municipalities reached historical peaks. Which, in turn, was already a repetition of what had been registered in the previous quarter. And the previous. And the one before that.

And as much or more relevant: 14 out of the 18 municipalities in the LMA have successively registered, quarter after quarter, all-time maximums in the last four years.

But... it is equally clear that despite the consistent appreciation of housing prices in the LMA, the rate at which it is happening has been slowing. There are only five municipalities where the appreciation between Q2 2020 and Q2 2022 was higher than the appreciation between Q1 2018 and Q1 2020.

They are Alcochete, Mafra, Sesimbra, Vila Franca de Xira and Palmela.

So where exactly is the appreciation curve?

Where can each euro invested be more profitable?

As we analyze the Pordata' data, the answer seems to be clear: the most significant land appreciation is happening in municipalities with lower population densities. Alcochete and Palmela have less than 150 inhabitants per sq. km. Sesimbra 268, Mafra 300, and Vila Franca 432. Here are some terms of comparison: Odivelas and Lisbon are around 5,500 inhabitants per sq. km, and Amadora is over 7,000.

Prices are rising more in the less dense areas of the LMA. In Peri-urban areas. Usually characterized by a more scattered population, and even by some similarities to rural areas. Which is in line with the common sense triggered during the pandemic: more than ever, people have shown a willingness to exchange centrality for space.

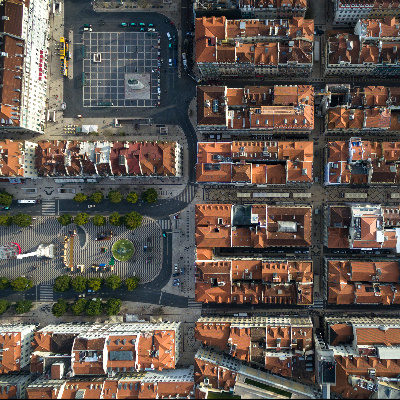

LISBON CITY PARISHES

By Sebastio.

Q1 2018 – Q1 2020

Source: Statistics Portugal.

Q2 2020 – Q2 2022

Source: Statistics Portugal.

Let's start with the evidence: prices in the parishes of Santa Maria Maior, Misericórdia, and Santo António have fallen in the last two years [values in red represent price drops compared to the previous quarter, and the ones in bold register peaks in that parish during the period in question]. And if the drop in Santo António (-0.1%) essentially reflects a stabilization of values, the same cannot be said of the other two. Misericórdia and Santa Maria Maior: these two parishes were the most impacted by the limitations of short-term rental, which we have already discussed here.

In any case, when comparing one table with the other, we observe the same trend reflected in the LMA numbers, but in a more obvious format.

Property prices have continued to rise, but this growth is increasingly taking place at a slower pace.

So where is the greatest appreciation? In Marvila.

Between Q1 2018 and Q1 2022, the median value/sq m of the properties transacted grew by 135.5%. Which, just to get a sense, represented exactly twice as much as the second-highest price evolution in Lisbon (Beato, with 67.6%).

But what Q2 2022 presents us with is the most impressive figure I have ever seen: between Q1 and Q2 2022, the median values/sq m in that parish grew 51.8%.

This means that the value of transactions in Marvila grew more, in just one quarter than most municipalities and parishes nationwide in four years.

And that makes Marvila, in the 2nd quarter of 2022, the second most expensive parish in Lisbon.

Do you know where Marvila was four years earlier, in the 2nd quarter of 2018? You can confirm it in table 3.1: it was the cheapest of the capital's 24 parishes.

In June, I had already explained here what was happening in the riverside area of Marvila. If you don't feel like reading the text, you can stick with the following paragraphs. The first one is a cheeky copy-paste of what I had written here in January 2020:

Marvila's prices coincide, more and more, with the sq m values of this development, which has been exerting a positive impact on that area, namely in attracting investment (I could easily enumerate 10 residential projects of new construction and urban rehabilitation). This investment not only adds value to the built heritage, but also attracts a new universe of inhabitants to the area, which in turn continues to attract new business opportunities. The outcome? The riverside area of Marvila is no longer the same. But it is still a prototype of what it will be in the future.

Which, in investment language, can be very simply translated: the price of land is higher than it was yesterday but is still below its tomorrow's value.

What other areas of Lisbon where each euro invested can, predictably, generate capital gains? Wherever there is an urban intervention that can significantly enhance the perception of what it means to live there. After all the dynamics of the last few years, there is practically only urbanized space in the parish of Marvila and in Alta de Lisboa (which includes the parishes of Lumiar and Santa Clara). But there are still small changes, with more localized effects, that can change the perception we have of the value of a neighborhood, square, or street (keeping up with the expansion plan of the Lisbon Metro is always a good idea).

MUNICIPALITIES IN THE

PORTO METROPOLITAN AREA

By trabantos.

Q1 2018 – Q1 2020

Source: Statistics Portugal.

Q2 2020 – Q2 2022

Source: Statistics Portugal.

When we look at Tables 3.1 and 3.2 [values in red represent price drops compared to the previous quarter, and the ones in bold register peaks in that municipality during the period in question], we see something we had already seen in LMA: neighboring municipalities with good accessibility to the center of the metropolitan area (and I'm thinking of Matosinhos, Gondomar and Vila Nova de Gaia) show very expressive appreciations.

Allow me to highlight the following: the three municipalities with the lowest valuations in the pre-Covid period (Espinho, Arouca, and Trofa), registered very significant increases in the last two years, of which stands out 42.6% of Trofa, 10% more than any other of the 17 municipalities of the Porto Metropolitan Area (PMA).

But unlike the LMA, and except for the municipality of Arouca (64 inhabitants per km2), there does not seem to be an obvious correlation between low population density and the dynamics of valorization during the pandemic.

An interesting note: (according to Confidencial Imobiliário, a database specialized in the residential segment) Vila Nova de Gaia is the municipality with the highest number of residential properties in the pipeline in the country. Between January and August, 1,900 new residential properties were submitted for licensing in that municipality, equivalent to 7% of the national total. This is expected to have a positive impact on the housing supply in what is the third most populated municipality in the country, after Lisbon and Sintra (and ahead of Porto).

PORTO CITY PARISHES

By Rh2010.

Q1 2018 – Q1 2020

Source: Statistics Portugal.

Q2 2020 – Q2 2022

Source: Statistics Portugal.

From the observation of Tables 4.1 and 4.2 [values in red represent price drops compared to the previous quarter, and the ones in bold register peaks in that parish during the period in question], two things stand out.

1) The city of Oporto's parishes maintain a more vigorous pace of valuation than their Lisbon equals. A partial explanation may be that the pressure on real estate in Portugal started in the historical center of Lisbon. And only one or two years later, it replicated itself in Oporto. In other words, there is probably still more room left in the center of this northern city for new construction or urban renewal projects.

This can be relatively easy to demonstrate with the help of some data. Lisbon is 100 sq km in area, and between January and August of this year, the municipality registered 1,100 new dwellings for licensing. In the same period, there were 1,400 licensing requests for new residential properties in Porto, a city of 41 sq km.

2) Prices are higher in the Union of Freguesias (UF) of Aldoar, Foz do Douro, and Nevogilde (which includes the famous "Foz"), and accompanied by the historical center (UF of Cedofeita, Santo Ildefonso, Sé, Miragaia, São Nicolau and Vitória), and the geographical area that lies between the two previous ones (UF of Lordelo do Ouro and Massarelos).

But in recent years, it was first in Bonfim and more recently in Campanhã that values skyrocketed. As prices in the historical area have risen, the interest in the Eastern neighborhoods has increased. After all, how many alleys around Jardim de São Lázaro or Campo 24 de Agosto haven't become fashionable places? Looking at these two tables, one might say that after Bonfim, Campanhã will be the next cool parish.

And this is also what the deliberation that the Oporto Municipal Assembly voted on last month suggests. Regarding the suspension of new registrations of Local Accommodation (short-term renting) in the União de Freguesias de Cedofeita, St. Ildefonso, Sé, Miragaia, S. Nicolau, Vitória and in the Freguesia of Bonfim.

Which is an indicator that the most significant valuation in those parishes has already happened. Limiting the issuance of new licenses in a given area negatively impacts the potential profitability of a given property and, therefore, the perception of its market value (which is precisely what happened in the parishes of Santa Maria Maior and Misericórdia, in Lisbon).

In fact, regardless of what you may think about this measure, this is precisely the effect that the municipality intends: to curb/counteract the rise in housing prices in those parishes.

MUNICIPALITIES OF THE DISTRICT CAPITALS AND THE REGIONAL GOVERNMENTS OF THE AZORES AND MADEIRA CAPITALS

By malajscy.

Q1 2018 – Q1 2020

Source: Statistics Portugal.

Q2 2020 – Q2 2022

Source: Statistics Portugal.

At Primary School, back in the '80s, I learn that Portugal is a bi-macrocephalic country. Even today, almost forty years after I heard this, the metropolitan areas of Lisbon and Porto still account for about 45% of the national population.

And what was the other thing? The coast was much denser than the interior. And that should be the starting point for analyzing tables 5.1 and 5.2 [values in red represent decreases compared to the previous quarter, values in bold are the maximum registered in that municipality throughout the period under analysis].

In general, the land is more expensive in coastal areas. First of all, these geographical areas tend, nearly always, to have a higher population pressure (and demography is the most elementary variable to understand the residential dynamics of a given place). And it is not a coincidence that Portalegre, the district capital with the lowest value/sq m in the whole country, is also, according to the 2021 Census, the district capital with the least population, and the one that lost the most inhabitants in the previous ten years.

A curious note: Setúbal is the municipality, among all these district capitals and seats of the regional government, that has appreciated the most in the last four years. But Setúbal is also an integral part of LMA, which brings us back to the bi-macrocephaly I mentioned earlier. On the other hand, Évora is – notwithstanding other reasons – due to its historical heritage (and the tourist dimension that this implies) and the University, the most expensive city in the entire interior.

Another note: the seven most expensive municipalities are all home to universities. A university, or even a polytechnic institute, always represents a very significant impact on any medium-sized Portuguese city.

Covilhã – the only university headquarters in mainland Portugal that is not a district capital – is a good example of this: house prices there have grown more than in the two closest district capitals, Castelo Branco and Guarda.

Accessibility also matters (and a lot): in the first half of the table, only Évora and Setúbal are not served by an airport or Alfa Pendular (high-speed railway line). And among the ten least valued cities are Viseu, Vila Real, and Bragança: the three district capitals that do not even have an active railway station.

This is not to say that the interior does not capture the attention of the Portuguese and foreigners. The geographic limitations on eligibility for golden visas through the purchase of homes were also intended to foster this interest. And some companies are also investing outside the most obvious urban centers: IBM has its competence and research centers in Viseu, Fundão, Tomar, Portalegre, and more recently in Vila Real.

But Portugal is, by its physical conditions, a country projected onto the sea. No doubt its more than 800km of coastline, plays an important role in its ability to attract people from all over the world.

For some reason, the municipalities of Grândola (which encompasses Tróia and Melides) and Aljezur (the heart of the Costa Vicentina) recorded, between Q1 2018 and Q2 2022, growths of 77.6% and 74.8% in the median value of residential properties sold.

And I find it hard to believe that rising interest rates will have a significant impact on the prices of these two havens on earth.

By Tiago Fernandez.

CONCLUSIONS

The bulk of real estate development and household demand has expanded to the metropolitan areas of Lisbon and Porto, due to the shortage of available space in the center of the two largest cities.

Miraflores is perhaps one of the most obvious cases in the LMA (the one I know best). The new construction projects there, are not necessarily for those who cannot afford the price of land in Lisbon. But also for those who prefer to live between Monsanto, the accesses to the A5 Highway, and the Tagus estuary, rather than in the city center.

And it seems undeniable that there is more interest in less urban areas or medium-sized cities (whose historic centers are receiving the same attention and investment that we have seen Lisbon and Porto attract in the recent past).

Will this lead to the much talked about reduction of prices in the centers of the two largest cities? It seems hard to imagine, except for a very adverse circumstantial scenario, that the demand for housing in the center of Lisbon and Oporto will weaken. Will that be the case?

INTEREST RATES

It is unreasonable to expect the rise of interest rates will not affect demand. In the best-case scenario it might not inhibit it, but it will always end up squeezing the purchasing capacity of those who depend on credit.

Last year in Portugal, according to the Statistics Portugal, 165,682 residential properties were sold, with an average value of 169,600€. In the same period, according to the Bank of Portugal (BP), 116,640 home loan contracts were signed with an average value of 126,580€.

This means that in 2021, 70% of home purchases in Portugal were financed by banks to 75% of their value.

Perhaps for this reason, the Bank Lending Survey published by BP in October, in the chapter dedicated to the demand for loans by households, mentions a "slight decrease, in particular for house purchase."

Remember when rates moved in the opposite direction? They made credit more attractive and, to some extent, have created the illusion of a lower monthly housing cost (which is a fact, but – in a variable rate context – it is only a temporary one). On the other hand, they favor the inexistence of alternative investments, which translates into a lower requirement when it comes to the profitability of a real estate investment.

Now it is the turn of rising interest rates. The monthly house payment burden will seem less attractive (but probably be more realistic in the long run), and some investors may begin to rediscover investment alternatives that, in a scenario of historically low-interest rates, have virtually ceased to exist. Or maybe be more selective in their real estate investments.

PORTUGAL IN THE WORLD

As has been said on this page a few times, demographics is one of the most relevant variables in the study of the real estate market, and also the most overlooked.

Even though the country's total resident population has remained virtually unchanged over the last 20 years, there is a slight nuance: in the last five years alone the foreign population has grown by 78%. That's 300,000 more people (from 393,000 to 699,000 residents of other nationalities). And this is also, in some way, the outcome of the growing notoriety of the country. Twenty years ago, when I used to backpack, I had to explain to many non-Europeans that my mother language was not Spanish.

Today, whether because of Cristiano Ronaldo or the avalanches of tourists arriving here every day, there doesn't seem to be a single person with internet access who doesn't know Portugal, recognizes it as a sovereign country, and – with a bit of luck – even knows someone who has already been here (and says wonderful things about the country).

And this notoriety exerts, through a wide range of dynamics, an impact on the value of each of the homes of the people reading this article.

Somewhere between the interest rate hikes and an inflationary context, and the growing visibility and reputation of Portugal in the world, lies the near future of the real estate market in Portugal. The most reasonable assumption is that demand will suffer, and the number of transactions will go down when compared to 2021. How much? We will see. But this will probably be the most differentiating variable in the evolution of prices.

Portugal is a small country but, even so, with plenty of room for a whole universe of heterogeneities. So where some might expect a decrease, all they will probably find is a slowdown. But just as in some places growth will remain high, there will be others where prices will go down, even if only marginally (and not necessarily in all market segments).

I believe that the tables shared here can help you understand where.

But don't forget: it is very unusual that a practical case (the sale of your property or the potential acquisition of another) it's merely defined by considerations and figures practiced in a given municipality or parish. Understanding the local dynamics is (and by local, we may be referring to a street only), almost always, the best advantage to better assess the opportunities and risks that each business comprises.