Housing market • House prices • Economy • Coronavirus

31 March 2020

All those who are interested in the residential real estate market are wondering about the effect on house prices. There is however a variable that so far nobody has been able to determine: the amount of time that the Coronavirus will make us wait until everything returns to something similar to what one can call normality. Until then, in an attempt to better understand the times ahead, it is important to comprehend what happened in the last decade.

Last week, the National Statistics Institute (INE) published the House Price Index for the fourth quarter of last year. Although this data refers to 2019, this did not prevent INE from including a reference to the impact of Covid-19 in the introduction of its report. And it did so quite clearly: “It is expected that the analyzed trends will change substantially”. I thus propose to describe the evolution of the residential real estate market in the last 10 years through its two most relevant indicators. And attempt, from there, to try and understand what could happen from now on.

When we refer to the evolution of the real estate market, there are two variables whose importance stands out from the others: number and value of transactions. Traditionally, it is the variation of these quantities (and how they evolve) that usually defines how attractive it is, in a given place at a certain time, to invest in real estate.

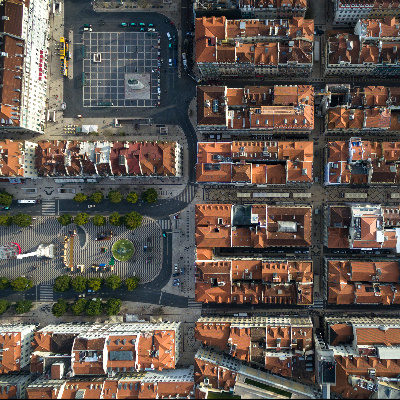

by mlehmann78

Number of transactions

Graph 1 shows how the number of houses bought and sold has evolved over the past decade.

(source: INE)

2012 and 2013 were the years that recorded the lowest number of transactions in almost all national regions (the exception is Madeira, where the minimum value was reached in 2014). It is important to remember, for a better contextualization of this data, that the Memorandum of Understanding between the Portuguese State and the Troika (International Monetary Fund, European Commission and European Central Bank) was signed in May 2011. And that those times (and the ones that followed) were marked by a period of economic downturn and social upheaval. In other words: when indicators such as the Gross Domestic Product or the Employment Rate fall, the number of families looking for a new home is not expected to increase.

On the other hand, it is apparent that, between 2012 and 2019, the number of real estate purchases and sales per year in Portugal more than doubled. Being that, during the same period, values in the Lisbon Metropolitan Area (LMA) almost tripled. So one can acknowledge the impact of this dynamics on the rehabilitation of Lisbon's urban fabric. And how did the national economy behave in this period? Since 2014, the year in which the Troika left Portugal, the public administration's budget deficit has been drastically reduced, the unemployment rate has halved, and public debt has decreased.

In any case, and as previously shared in January, there were already some signs that the number of real estate transactions would not continue to grow at the same pace. In Portugal, this figure rose 1.5% from 2018 to 2019. In the LMA (which concentrated more than a third of all transactions carried out across the country) this indicator increased by only 0.3%. In the Porto Metropolitan Area and in the Algarve, the volume of transactions even dropped slightly compared to 2018.

Value of Transactions

Graph 2 shows the average variation in house prices over the last decade in Portugal.

(source: INE)

We have already discussed, first via text and then video, the reasons behind the sharp evolution of prices in recent years in Portugal. The evolution of the real estate market is conditioned by a constant interaction between Economy, Demography, Interest Rates and Public Policies. And all of these fields reflected substantial changes over the past decade.

Now consider the case of foreign investment. Could it be that a pandemic that has drastically reduced the circulation of people between different parts of the globe, might not also reduce (even after the constraints currently in force are lifted), the tendency towards the purchase, in a foreign country, of the only asset that can never be retrieved from its place of origin? If that were to happen, a significant drop in the number of foreign nationals looking for a house in Portugal (and in other countries) would be expected. Which makes me question, for example, if the end of the Golden Visa concession through real estate investments in coastal areas, may not be re-evaluated. Or, on the other hand, if the benefits it grants, will continue to be valued to the same extent. The truth is: never before has globalization, almost always a symbol of sophistication and prosperity, aroused so many fears. Perhaps one year from now the world population will have other things to worry about. Or maybe not. Or can Portugal, on the other hand, emerge from this global public health crisis, with its safe place (or safe house...) status enhanced? I have no idea. Nor does the vast majority of us.

And how do we read the previous paragraph without remembering Tourism? And some private individuals and microenterprises, whose properties located in urban pressure zones, with no one to occupy them, will probably have to be rented (or sold) at lower prices than those that - just over half a year ago - would not have seemed attractive enough? There will be plenty of people relieved by a predictable drop in values. But they will only have reasons to smile if they do not face the risk of seeing their income reduced as well. Not to mention that, until today, I have not yet been able to understand - even after talking to some bank managers – whether or not the banks' willingness to enter into new mortgage loans will be substantially affected.

by radub85

But what draws most attention in the curve of Graph 2 (average change in the value of house purchases and sales in Portugal), are the similarities with that observed in Graph 1 (evolution of the number of transactions in Portugal). If not, notice: the negative values of the variation in the average rate of House Prices were verified from 2011 to 2013 when the least significant numbers of transactions were registered in 2012 and 2013. And the peak of the price rise verified in 2018 was followed by the number of transactions that reached a new peak in 2019 (with very similar values to those recorded in 2018). This parallelism leads us to a transactional logic which is responsible for a large part of the decisions on real estate acquisitions. Buying a house in a growing market is an attractive scenario for most investors (even more so in a context where financial products offer residual income). The perception of asset appreciation tends to generate, during a given period, an increasing volume of acquisitions due to the expectation of a future sale with profit generation. On the other hand, the perception of a potential depreciation of the property is based on greater unpredictability in closing a sale that generates capital gains and converts the asset into liquidity. Which is precisely what is most lacking in times of economic contraction.

In summary

The sovereign debt crisis severely affected the European economy and the national real estate market in the first half of the decade. A trend that began to be opposed after the Troika left our country. The proof of this is that - and equally according to the INE - between 2015 and 2019 the value of houses sold more than doubled (105.1%) and the number of transactions grew by 69.1%. 2019 ended with the highest transaction value of the last ten years (although very similar to 2018), and evidence that the appreciation of real estate assets was heading towards stagnation. But the quarter that ends today, the first of this new decade, can drastically mark the course of the coming years. I will therefore end with how I started. By quoting INE when publishing data for the last quarter of 2019: “It is expected that the analyzed trends will change substantially”.

_3140.jpg)